Short a put with a lower strike price and long a put with a higher strike price Short a call with a lower strike price and long a call with a higher strike price Long a put with a lower strike price and short a put with a higher strike price Long a call with a lower strike price and short a call with a higher strike price If we’re talking about bearish verticals, your choices are long put verticals for a debit or short call verticals for a credit. Remember, if we’re talking about bullish verticals, the two choices are long call verticals for debit or short put verticals for a credit.

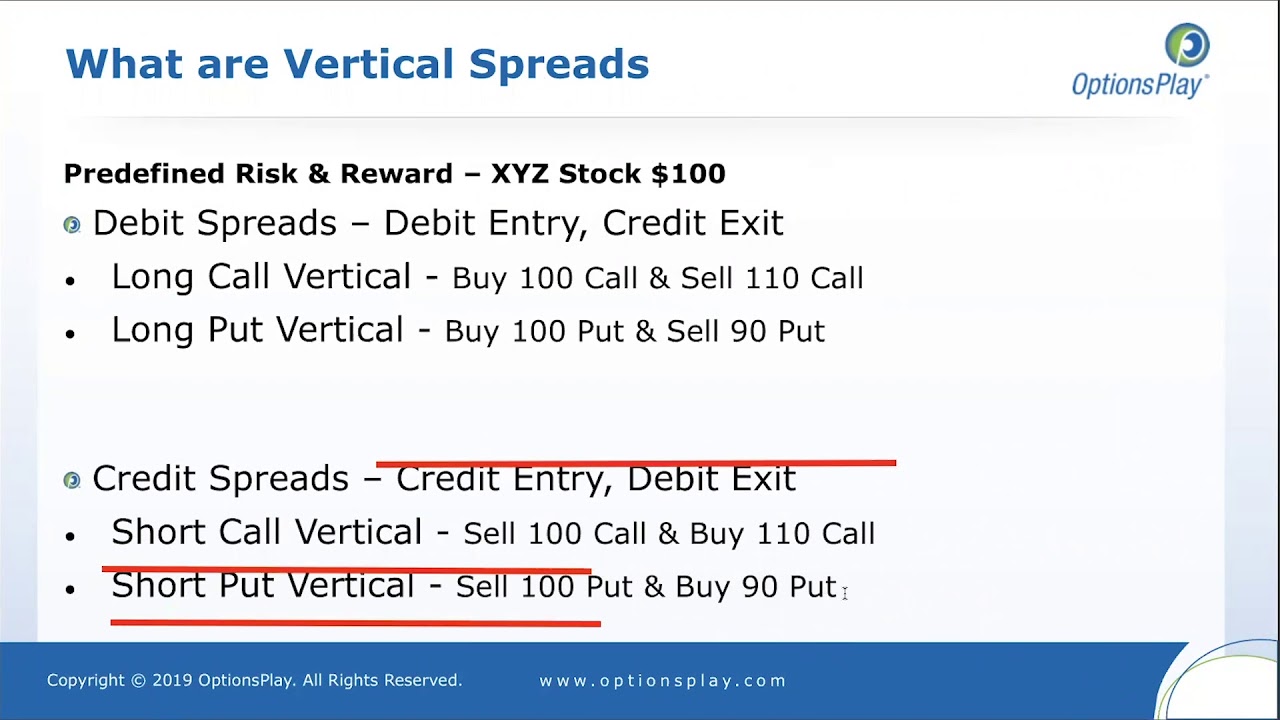

They’re composed of either a long and short call or a long and short put in the same expiration. A vertical could be a short-term speculation or long-term directional play. You can create a vertical with minimal risk or a lot of risk. You may recall a vertical spread is a defined-risk strategy that lets you make bullish or bearish speculative trades. Vertical spreads in particular are guilty of befuddling even the best of ’ em. Once you have the information you need, which options spread do you run with? Is there a way to automate the decision-making process? Perhaps. Is it high or low? Will it go up or down from here? This is where traders get hung up on strategy. If you trade options, not only do you need to know whether you think a stock will go up or down, but you have to consider volatility (vol), too. Not only are you most likely to go with the fly-in-the-front, one-leg-at-a-time method, but it’s also the obvious choice. Some choices are easy, like the way you put your jeans on. A premium below the threshold might be a candidate for a debit spread, and anything above it might be a candidate for a credit spread.Some traders use a premium threshold of one-third of the distance between the option strikes.The implied volatility (IV) percentile measures current IV relative to its high and low values over the past year.If the assignment takes place prior to expiration neither IBKR nor the clearinghouse will act to exercise a long option held in the account as neither party can presume the intentions of the long option holder and the exercise of the long option prior to expiration is likely result in the forfeiture of time value which could be realized via the sale of the option.

Depending upon the option strike prices, this may result in a net cash debit or credit to the account. Accordingly, if the long option has the same expiration date as the short and at expiration is in-the-money by a minimum of the stated exercise by exception threshold, the clearinghouse it will be automatically exercised, effectively offsetting the stock obligation on the assignment. In the case of US securities options, for example, the OCC will automatically exercise any equity or index option which is in-the-money by at least $0.01 unless contrary exercise instructions are provided by the client to the clearing member.

At expiration, many clearinghouses employ an exercise by exception process intended to ease the operational overhead associated with the provision of exercise instructions by clearing members. The answer depends upon whether the assignment occurred at expiration or prior to expiration (i.e., an American Style option).

0 kommentar(er)

0 kommentar(er)